Modern Policy Administration System Built for P&C Insurance Growth

Your legacy systems weren't built for today's digital-first insurance environment. pasCarrier.Net serves as the digital backbone, managing everything from initial quote through binding, endorsements, renewals, claims, and billing for property and casualty insurers who need operational speed without sacrificing customization.

Since 1996, Policy Administration Solutions has delivered modern policy administration systems that eliminate constraints while ensuring regulatory compliance you can prove.

What sets us apart? We say yes when competitors refuse:

Link independent policies with automated discount calculations

Deploy API-only solutions, preserving your existing interface

Modify core systems while maintaining single-architecture integrity

Deliver policy administration flexibility, impossible with rigid enterprise platforms

With pasCarrier.Net, you accelerate policy operations by 70% while maintaining the flexibility that defines your competitive advantage.

Schedule your personalized demo to see how P&C insurers reduce policy turnaround from 5-7 days to 24-48 hours.

Policy Administration System: Managing Your Complete Insurance Lifecycle

A policy administration system functions as the operational core for insurance carriers, orchestrating every transaction across the policy lifecycle. pasCarrier.Net automates submission clearance, client registration, quoting, binding, endorsements, renewals, and integrates seamlessly with claims and billing operations. This isn't middleware or a point solution—it's comprehensive policy lifecycle management designed specifically for property and casualty insurers navigating complex market conditions.

The platform processes everything in real-time. When underwriters update risk assessments, rating engines recalculate instantly. When policies bind, billing systems receive data automatically. When claims occur, adjusters access the complete policy history immediately. This synchronization eliminates the manual data transfers and reconciliation nightmares plaguing legacy systems

Policy Linking Nobody Else Delivers

Display Note: Competitive Positioning Blockquote

The following quote will appear in a shaded box with a bold left border and italics—drawing attention and emphasizing the competitor quote. In the live version, this will be set apart as a memorable visual highlight.

How it will look (approximate):

"Our system doesn't work that way." — Every Competitor

Here's where we fundamentally differ from enterprise vendors: pasCarrier.Net links independent policies while maintaining synchronization across all operations (rating, binding, endorsements, renewals) with automated discount calculations applied to combined premiums.

We modified our core architecture while preserving single-system integrity.

Why policy linking transforms operations:

Eliminates duplicate actions across linked policies

Reduces workflow steps by 70%

Enables sophisticated multi-policy pricing strategies impossible with rigid platforms

Powers entire business models competitors cannot support

One client's entire business model depends on this capability—a competitive advantage their previous vendor couldn't support.

See policy linking in action and discover what operational efficiency really means.

Regulatory Compliance You Can Prove

NAIC regulatory standards demand transparency, auditability, and multi-state coordination that many policy administration systems struggle to deliver. pasCarrier.Net generates state-specific compliance forms automatically, maintains comprehensive audit trails for every transaction, and produces regulatory reports meeting market conduct requirements without manual intervention. Our SOC 2 Type II certification validates enterprise-grade security controls protecting policyholder data across 45+ jurisdictions.

Compliance officers face mounting pressure as state regulations diverge. Our platform handles workers' compensation state reporting, premium tax filings, and statistical bureau submissions. ACORD data standards ensure seamless interoperability with regulatory systems. When auditors request transaction histories, our policy administration system produces complete documentation instantly.

That's compliance you can prove, not just a promise.

This automated compliance approach reduces compliance costs by 35% while ensuring regulatory readiness for P&C insurers managing multi-state operations and preparing for market examinations.

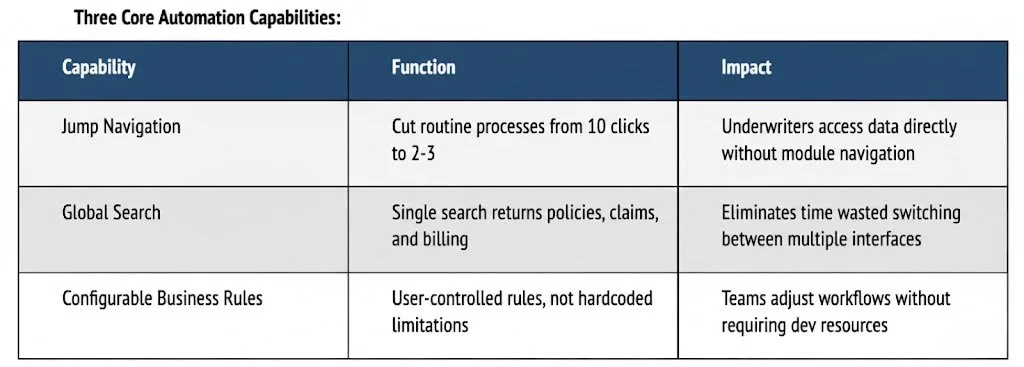

Operational Efficiency Through Intelligent Automation

Insurance automation benefits extend far beyond simple task completion. pasCarrier.Net delivers intelligent automation, reducing manual work while accelerating processing across all policy operations.

Measurable efficiency gains for operations directors:

Accelerate processing by 45%

Reduce manual data entry by 60%

Support 50% business growth using existing teams

Translate operational efficiency directly to profitability

Automation eliminates recurring manual tasks:

Scheduled payments process automatically

Automated diary creation ensures follow-up actions never slip through cracks

Real-time exports provide current data without waiting for batch processing

This isn't incremental improvement—it's a fundamental transformation of how policy administration systems enable operational efficiency.

Calculate your efficiency gains based on current policy volumes and processing times.

Core Systems Replacing Legacy Constraints with Modern Architecture

Legacy systems create integration barriers, limit innovation, and consume IT budgets through maintenance rather than strategic advancement. Modern core systems leverage cloud-native architecture delivering flexibility, scalability, and cost reduction impossible with on-premises platforms. pasCarrier.Net runs as a fully online solution providing real-time data access, automatic updates, and 99.9% uptime without the infrastructure burden.

For CIOs prioritizing technology modernization in 2025, cloud infrastructure represents the foundation for AI integration, API connectivity, and operational agility. Our platform reduces IT operational costs by 25% and maintenance overhead by 40%. These resources redirect from keeping legacy systems alive to driving business innovation.

Claims Processing Designed for Speed and Accuracy

Claims processing determines customer satisfaction and loss ratio performance. pasCarrier.Net integrates with pasClaims.Net to power complete claims management from first notice of loss through settlement.

Complete claims lifecycle management:

First Notice of Loss: Automated intake and initial reserves calculation

Investigation & Documentation: Comprehensive claim documentation with AI-powered summarization

Payments & Recoveries: Scheduled indemnity payments, vendor integration, subrogation tracking

Settlement & Closure: Litigation management, fraud detection, final settlement processing

Innovation Spotlight: AI-Powered Claims Summarization

Currently in UAT, production rollout planned.

Leverages Microsoft AI to digest multiple claim notes and attachments instantly—adjusters review intelligent summaries rather than scrolling through dozens of documents.

Impact: Accelerates claims resolution while improving accuracy and demonstrating our commitment to emerging technology adoption.

Automation capabilities throughout the claims process:

Create diary entries automatically based on business rules

Ensure supervisor approvals for authority limit exceptions

Integrate with external vendors for pharmacy and medical payments

Automate state-specific compliance forms

Maintain comprehensive documentation across all claim activities

Real-time visibility and analytics:

Complete claims performance reporting

High-risk exposure identification

Potential fraud indicators

Predictive analytics supporting loss management

Learn how AI accelerates claims resolution while maintaining compliance and control.

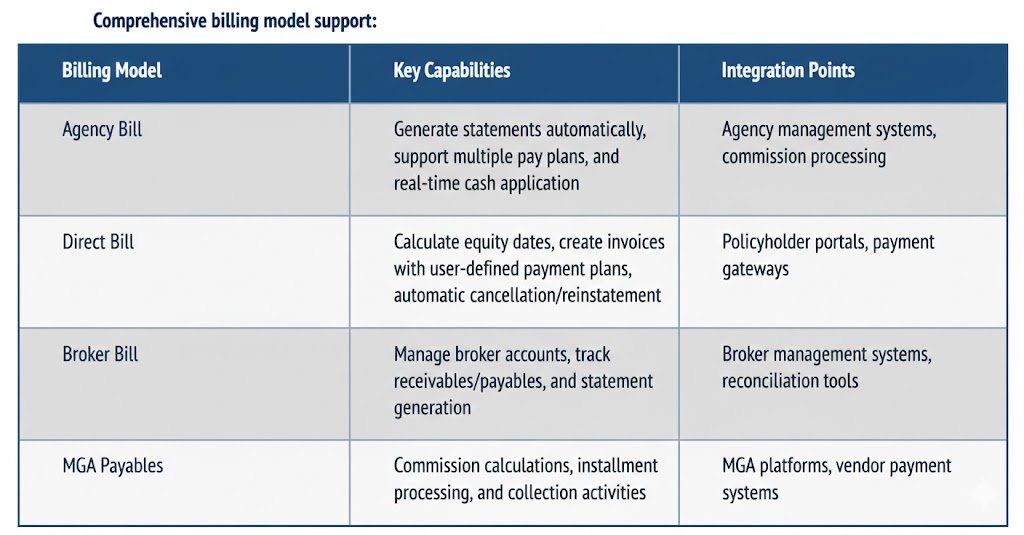

Billing Management Across Multiple Policy Systems

Here's another differentiator competitors avoid: pasBilling.Net connects to multiple policy administration platforms simultaneously (PAS and non-PAS systems), providing centralized billing operations across heterogeneous environments.

Use cases for multi-system billing:

Managing acquisitions with different legacy systems

Transitioning vendors gradually without business disruption

Running multi-system environments during migrations

Centralizing billing while evaluating multiple policy platforms

Automated payment processing and reconciliation:

Lock-box, ACH, credit card, and debit card payments

Automated reconciliation across all payment methods

Check processing, including voids and stop payments

Seamless integration with accounting systems

For carriers implementing phased modernization strategies, this integration flexibility eliminates the "rip and replace" risk.

That's flexibility without vendor lock-in.

Full Suite vs. Modular vs. Headless Deployment

Choose the deployment architecture matching your current environment and strategic goals.

Full Suite

Comprehensive policy administration capabilities with every module integrated.

Ideal for:

Carriers replacing legacy systems completely

New operations building from scratch

Organizations wanting end-to-end automation

What's included:

Every module is integrated (policy, billing, claims, rating)

Every workflow automated

Every report is coordinated across all operations

Modular

Selective adoption integrating specific modules with existing systems.

Ideal for:

Carriers with mixed vendor environments

Organizations modernizing incrementally

Operations requiring phased deployment

Deployment flexibility:

Use pasCarrier.Net for policy administration while connecting to existing billing

Deploy pasBilling.Net with competitor policy platforms

Implement pasClaims.Net integrated with legacy policy systems

Each module functions independently while integrating seamlessly when deployed together

Headless API

Our most distinctive offering: complete rating functionality via API without UI migration.

Ideal for:

Carriers with significant front-end investments

Agent networks integrating rating into their own portals

Organizations preserving existing interfaces while modernizing backend logic

Advanced rating capabilities:

Operates via API calls, providing complete rating functionality

Sophisticated temporal tracking across multiple effective dates and program variations

Handles mid-term endorsements, program transitions, renewal calculations, and retrospective audits automatically

Calculates accurately across complex multi-period policies (competitors require manual processing)

Agent portal integration:

Quote and bind remotely without accessing carrier systems directly

Preserve investments while enabling modern digital distribution

Explainable Artificial Intelligence: Transparency in Automated Decision-Making

Explainable AI regulatory requirements demand transparency and auditability when insurance carriers deploy automated decision-making. NAIC Model Bulletins and New York DFS regulations specifically require explainability, preventing "black box" AI systems from determining coverage, pricing, or claims decisions without documented reasoning. pasCarrier.Net addresses these mandates through transparent AI integration, maintaining audit trails and decision documentation.

Regulatory compliance in AI extends beyond simple disclosure. Insurers must demonstrate how automated decisions reached specific conclusions, identify bias risks, and provide appeals processes when AI recommendations affect policyholders. Our explainable artificial intelligence approach documents decision factors, maintains version control for algorithm changes, and produces regulatory review documentation meeting state requirements.

This transparency builds trust with regulators, policyholders, and internal stakeholders. When state examiners request AI decision documentation during market conduct examinations, you produce complete records immediately. When customers question rate increases, you explain contributing factors clearly.

When executives evaluate AI performance, they access quantifiable impact metrics.

Insurance Underwriting Enhanced Through AI

McKinsey insurance AI research documents measurable impact: 10-20% improvement in sales conversion rates, 20-40% reduction in customer onboarding costs, and 3-5% accuracy improvement in claims handling. pasCarrier.Net integrates AI-driven risk assessment throughout the underwriting process, from submission clearance through binding, accelerating policy turnaround from industry-standard 5-7 days to 24-48 hours.

The platform's intelligent client registration uses dynamic matching criteria identifying whether insureds are shopping policies across multiple carriers. This insight helps underwriters assess competitive positioning and price appropriately. Real-time risk assessment leverages customer-provided information, agent input, and publicly accessible databases, producing accurate quotes instantly.

For VP-level underwriting executives facing pressure to accelerate policy issuance while maintaining underwriting quality, AI-powered underwriting delivers both speed and accuracy. The rating engine supports complex comparative rating, table-driven rules, and flexible algorithms adapting to changing market conditions without requiring development resources.

Discover our AI underwriting capabilities and see how carriers improve conversion while reducing costs.

Cloud Infrastructure Supporting Modern Insurance Operations

2025 CIO priorities research reveals 89% of insurance CIOs increasing GenAI funding (38.1% average increase) while 86% boosting cloud and cybersecurity investment. This technology transformation reflects market reality: cloud-native platforms enable the operational agility, AI integration, and cost structure necessary for competitive advantage. pasCarrier.Net delivers these capabilities through Microsoft Azure infrastructure providing enterprise scalability, security, and global availability.

Cloud infrastructure eliminates capital expenditures for servers, reduces disaster recovery complexity, and enables rapid deployment of new capabilities. Our platform updates automatically without disruptive version upgrades or lengthy implementation projects. Security patches deploy seamlessly. Performance scales elastically based on transaction volumes.

This is the new operating model for insurance carriers, prioritizing innovation over infrastructure management.

New Operating Model for Strategic Transformation

The new operating model for P&C insurers emphasizes product modularity, rapid deployment, and architectural flexibility. pasCarrier.Net supports this transformation through configurable products, table-driven rating rules, and multi-company/multi-MGA processing. Launch new products in days rather than months. Adjust underwriting guidelines without development cycles. Scale operations without infrastructure constraints.

This operating model extends to organizational structure. IT teams focus on business enablement rather than system maintenance. Underwriters configure rules directly rather than submitting IT requests. Operations directors adjust workflows through business user interfaces rather than waiting for development resources.

Cloud infrastructure and modern core systems democratize system control.

Schedule an architecture consultation to discuss how modern infrastructure enables your strategic goals.

Flexible Deployment Architecture for Every Environment

API-first architecture eliminates vendor lock-in while preserving the flexibility that CIOs demand. pasCarrier.Net deploys three ways: full suite (complete policy, billing, claims, rating), modular components (integrate specific modules with existing systems), or headless rating engine (API-only processing, preserving your current interface). This architectural flexibility distinguishes us from rigid enterprise vendors forcing all-or-nothing decisions.

Deployment Flexibility CIOs Need

This architectural approach addresses the vendor lock-in concerns dominating CIO technology priorities. You're never trapped by single-vendor dependencies. Deploy what you need today. Add capabilities when ready. Replace components independently. Preserve investments while modernizing incrementally.

Agent portal integration demonstrates this flexibility powerfully. Agents transact directly from their own platforms while carriers maintain centralized policy administration and control. This enables modern digital distribution strategies without compromising governance. Quote-to-bind cycle times compress. Agent training requirements decrease. Distribution costs decline through self-service capabilities.

Request custom implementation roadmap tailored to your current systems and strategic goals.

Why P&C Insurers Choose pasCarrier.Net

Twenty-nine years in business since 1996 means we've solved problems competitors haven't encountered yet. Our extensive customization library reflects decades of client implementations: battle-tested solutions maintaining single-system architecture. When you need modifications, we've likely solved similar challenges before. When you need truly custom development, we commit to changes competitors refuse.

We've proven this commitment repeatedly. The firefighter insurance provider requires policy linking. The agent network needing API-driven discount systems. The multi-carrier operator is consolidating billing across heterogeneous environments.

These aren't theoretical capabilities. They're production deployments solving real business problems.

The platform combines modern technology with proven reliability. Latest UI frameworks deliver a contemporary user experience. Microsoft AI integration demonstrates innovation and commitment. Cloud-native architecture ensures scalability. Meanwhile, 29 years of operational history validates stability and longevity that competitors can't match.

Transform your policy administration operations with proven technology, unmatched flexibility, and 29 years of insurance expertise. Contact Policy Administration Solutions today to schedule your personalized demo and discover how pasCarrier.Net accelerates your competitive advantage.

Frequently Asked Questions

-

A: Modern policy administration systems leverage configurable product structures and table-driven rating rules that eliminate development bottlenecks. pasCarrier.Net enables operations teams to configure new products directly through business user interfaces rather than submitting IT requests that queue for months. The platform's product modularity supports rapid deployment through configurable underwriting rules, rating algorithms, and compliance forms. Carriers using this new operating model cut product deployment schedules from months to weeks, achieving 25-40% faster time-to-market while maintaining full regulatory compliance across jurisdictions.

-

A: Legacy policy administration systems create operational bottlenecks that compound over time. Warning signs include policy processing taking 5-7 days when competitors complete transactions in 24-48 hours, staff spending excessive time on manual data entry and reconciliation, and inability to launch new products within weeks. When your team spends more time working around system limitations than serving customers, you've reached the critical tipping point. Modern PAS platforms like pasCarrier.Net eliminate these constraints through intelligent automation, reducing workflow steps by 70% while maintaining the flexibility your business requires.

-

A: Policy Administration Solutions demonstrates vendor flexibility through proven customization commitment while maintaining single-system architecture integrity. When a firefighter insurance provider required policy linking with automated cross-policy discount calculations, competitors declined with "our system doesn't work that way." We modified our core architecture, spending months developing this capability that now powers entire business models competitors cannot support. Our 29-year customization library reflects battle-tested solutions from decades of client implementations.

-

A: Explainable AI regulatory requirements demand transparency when insurance carriers deploy automated decision-making. NAIC Model Bulletins and New York DFS regulations specifically require explainability, preventing "black box" AI systems from determining coverage or pricing without documented reasoning. pasCarrier.Net addresses these mandates through transparent AI integration maintaining comprehensive audit trails and decision documentation. The platform documents decision factors, maintains version control for algorithm changes, and produces regulatory review documentation meeting state requirements. When state examiners request AI decision documentation during market conduct examinations, you produce complete records immediately—compliance you can prove, not just promise.

-

A: We integrate Microsoft AI for intelligent claims summarization and predictive analytics supporting underwriting, risk assessment, and rating decisions.

Explainable AI approach:

Maintain audit trails documenting decision factors, algorithm versions, and reasoning

Meet NAIC Model Bulletin and state regulatory requirements for AI transparency

Produce complete records immediately when regulators request AI decision documentation

This positions carriers ahead of evolving AI regulations while enabling sophisticated automation.

-

A: Integration activities and data migration represent the most common challenges derailing modernization projects. pasCarrier.Net's API-first architecture provides phased migration strategies, reducing implementation risk. The platform deploysin three ways: full suite replacing complete legacy infrastructure, modular components integrating specific capabilities with existing systems, or headless rating engine via API preserving current front-end interfaces. Comprehensive testing plans, early stakeholder communication about integration changes, and clearly defined outcomes prevent projects from derailing due to IT environment complexity.